Payroll Management

Faster Payroll, Accurate Payouts.

Say goodbye to Excel hassles and errors. Ensure 100% compliance, on-time salary disbursement, and effortless payroll management for stress-free month-ends.

What is Payroll Management?

Payroll management is a procedural approach to the management of employee remuneration entailing salaries, deductions, bonuses, and all legal regulatory compliance associated with administering payroll. This ensures complete accuracy in determining and timely payments of dues to employees according to tax and labor laws.

The Critical Role of Payroll Managementsin Business Success

Data Security

Payroll data contains sensitive employee and financial information, making security a top priority. MiHRMS employs advanced encryption, multi-layer authentication, and secure cloud storage to protect payroll records from unauthorized access and cyber threats.

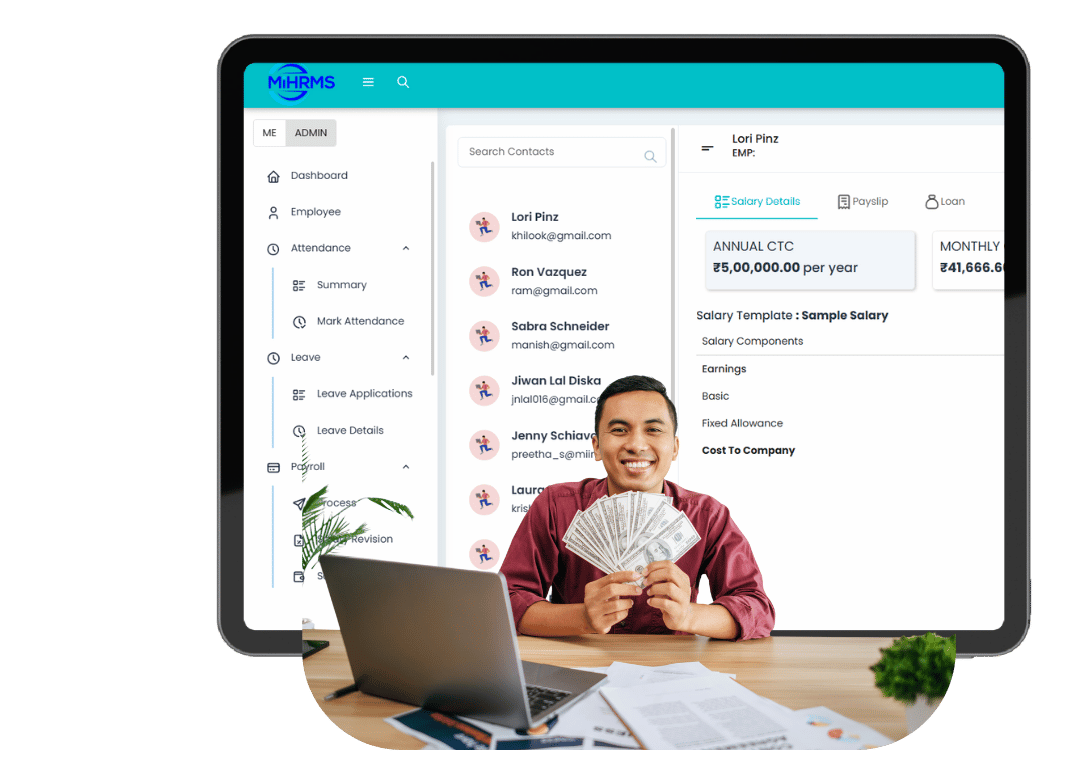

MIHRMS Automation

MIHRMS offers a single-window solution to streamline payroll management, automate tax calculations, ensure error-free payroll processing, and customize reports. By integrating attendance and leave management modules with the HR modules, it enhances operational efficiency, compliance, and employee satisfaction while minimizing administrative burden.

Unified HR Operations

Merged payroll with attendance, leave, and performance management to enable error-free and automated salary calculations through remarkable data synchronization to enable new workflows in HR operations with good efficiency and reliability.

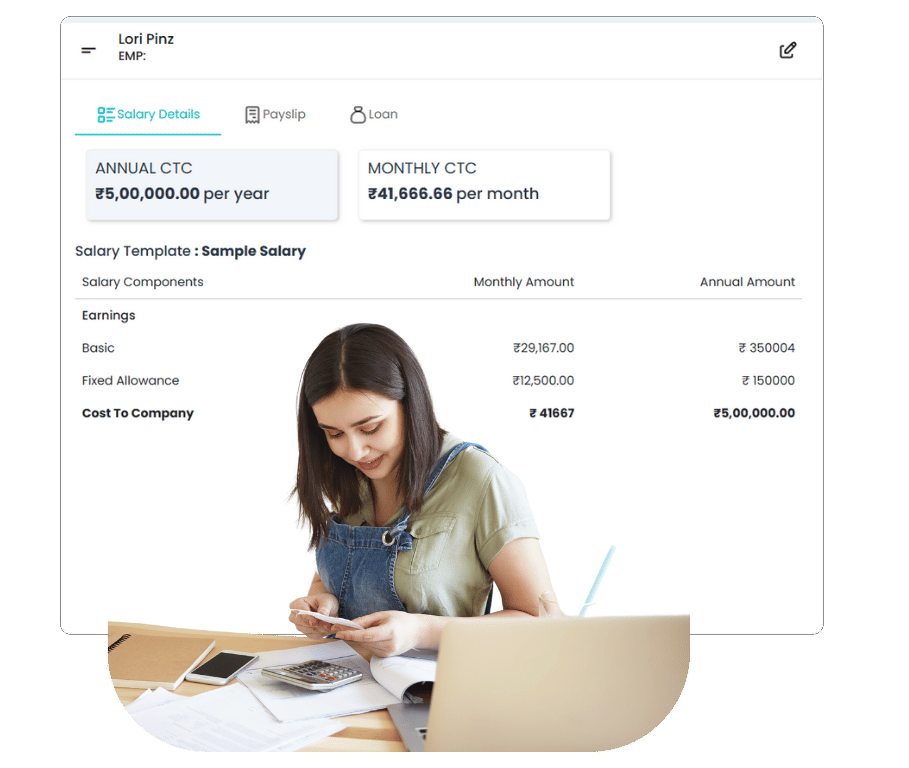

Employee Self-Service Portal:

Employees should have easy access to their payroll information. MiHRMS provides a self-service portal where employees can view payslips, download tax forms, check deductions, and update their banking details, reducing HR queries and improving transparency.

Custom Reports

Payroll analytics play a vital role in audits and business planning. MiHRMS generates detailed payroll reports, including salary breakdowns, tax summaries, overtime reports, and compliance records, helping businesses make informed financial decisions.

The Critical Role of Payroll Managements in Business Success

Precision and Effectiveness

MIHRMS completely mechanized the operations for salary calculation and made it error-free, not time-consuming at all.

Less Administrative Burden

Automation reduces HR workload by handling tax calculations, deductions, and payroll disbursements efficiently.

Increased Employee Trust

Transparent payroll processing with detailed payslips and timely salary deposits enhances employee confidence.

Compliance as well as Security

MiHRMS ensures adherence to labor laws while implementing strict security measures to protect payroll data.

Seamless Tax & Deduction Management

Automate tax calculations, PF, ESI, and other deductions to ensure accurate and hassle-free payroll compliance.

Comprehensive Payroll Reports

Generate real-time reports on salary breakdowns, tax deductions, and compliance metrics for better financial planning.

Reimagine and Automate your Complete HR Processes

- Streamline employee processes from onboarding to offboarding

- Automate payroll, attendance, and benefits administration

- Ensure HR compliance with built-in policies and audit tools

- Resolve complex HR issues quickly with tailored solutions

- Access real-time data and analytics for better decision-making

- Save time, reduce manual tasks, and boost overall productivity

See MiHRMS in Action

Ready for a demo? You’re in the right place.

Whether you’re looking to simplify HR tasks or improve overall efficiency, MiHRMS offers a centralized platform that saves time, streamlines processes like attendance and payroll, and enhances employee satisfaction with its user-friendly features.

Payroll Management: FAQs

How does MiHRMS ensure accurate payroll processing?

MiHRMS automates payroll calculations by integrating real-time attendance, leave balances, tax deductions, and compliance policies. It eliminates manual errors, ensuring precise salary disbursements every time. The system also generates detailed payslips with tax breakdowns, reducing employee queries and improving payroll accuracy.

Can MiHRMS handle tax deductions and compliance requirements?

Yes, MiHRMS automatically calculates and processes taxes, provident fund (PF), employee state insurance (ESI), and other statutory deductions as per government regulations. It keeps up with changing compliance laws, reducing HR’s burden and ensuring error-free tax filings.

Does MiHRMS generate payroll reports for financial planning?

Absolutely! MiHRMS provides comprehensive payroll reports, including salary summaries, tax liabilities, overtime costs, and compliance records. These reports help HR and finance teams track payroll expenses, forecast budgets, and maintain financial transparency with ease.